Cash is king in Austria and Germany, and they’re fighting to keep it that way.

Harald Mahrer, Austria’s economy minister, is pushing back against EU plans to restrict the use of cash. Yesterday (Feb. 12), according to Bloomberg, he told Austrian public radio station Oe1:

We don’t want someone to be able to track digitally what we buy, eat and drink, what books we read and what movies we watch… We will fight everywhere against rules.

Earlier this week, the German finance ministry announced plans to restrict cash payments of more than €5,000 ($5,600). Unsurprisingly, in a country where only 18% of payments are made with cards, Germans weren’t too pleased with the proposal. Green Party lawmaker Konstantin von Notz echoed Mahrer’s criticism, describing cash payments “a freedom that has to be defended.”

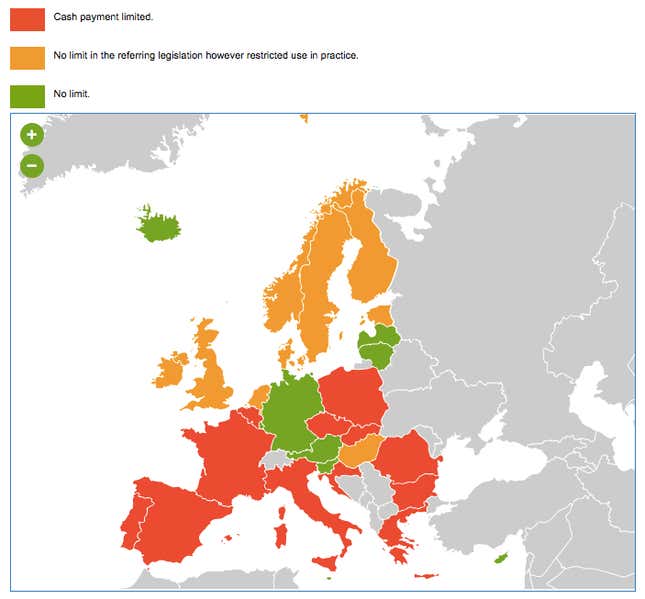

Austria and Germany are among a handful of countries in Europe to put no limits on cash payments:

At the same time, other EU ministers are growing concerned with the use of cash—and the €500 note, in particular—by criminals and terrorists. “There are risks that large notes and large cash amounts can be easily used for terrorism financing,” Dutch finance minister Jeroen Dijsselbloem told reporters this week, according to Reuters.

The number of €500 notes in circulation has soared since the founding of the euro zone, while €10 and €20 notes has remained stable. Currently, €500 notes make up one third of all cash in circulation in the euro zone.

Yesterday, ministers called on the European Central Bank to “explore the need for appropriate restrictions” on cash payments and high-denomination notes, setting the scene for the potential introduction of a common limit on cash payments across Europe. The central bank will report back by May, when leaders are unlikely to be any closer on resolving their differences on the matter.